Writing in The New York Times, the business columnist Eduardo Porter quotes Paul Ehrlich quoting Kenneth Boulding: “Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.” Then Porter, siding with the economists if not the madmen, proclaims that economic growth must continue if “civilization as we know it” is to survive. (He doesn’t explicitly say the growth needs to be exponential.)

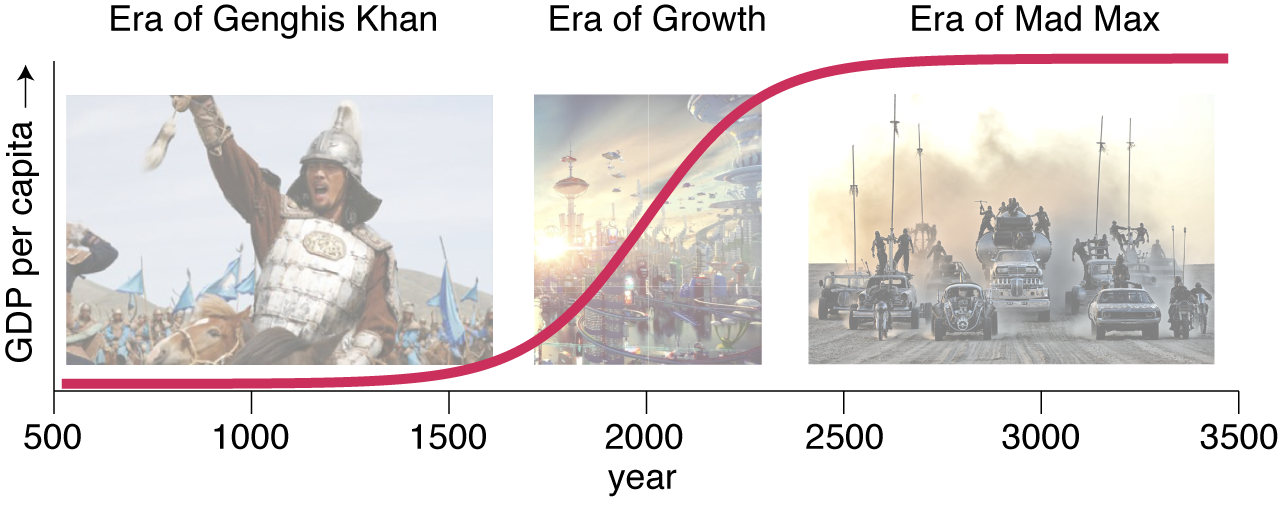

Porter links continuing growth not just to prosperity but also to a host of civic virtues. “Economic development was indispensable to end slavery,” he declares. “It was a critical precondition for the empowerment of women…. Indeed, democracy would not have survived without it.” As for what might happen to us without ongoing growth, he offers dystopian visions from history and Hollywood. Before the industrial revolution, “Zero growth gave us Genghis Khan and the Middle Ages, conquest and subjugation,” he says. A zero-growth future looks just as grim: “Imagine ‘Blade Runner,’ ‘Mad Max,’ and ‘The Hunger Games’ brought to real life.”

Let me draw you a picture of this vision of economic growth through the ages, as I understand it:

For hundreds or thousands of years before the modern era, average wealth and economic output were low, and they grew only very slowly. Life was solitary, poor, nasty, brutish, and short. Today we have vigorous economic growth, and the world is full of wonders. Life is sweet, for now. If growth comes to an end, however, civilization collapses and we are at the mercy of new barbarian hordes (equipped with a different kind of horsepower).

Something about this scenario puzzles me. In that frightful Mad Max future, even though economic growth has tapered off, the society is in fact quite wealthy; according to the graph, per capita gross domestic product is twice what it is today. So why the descent into brutality and plunder?

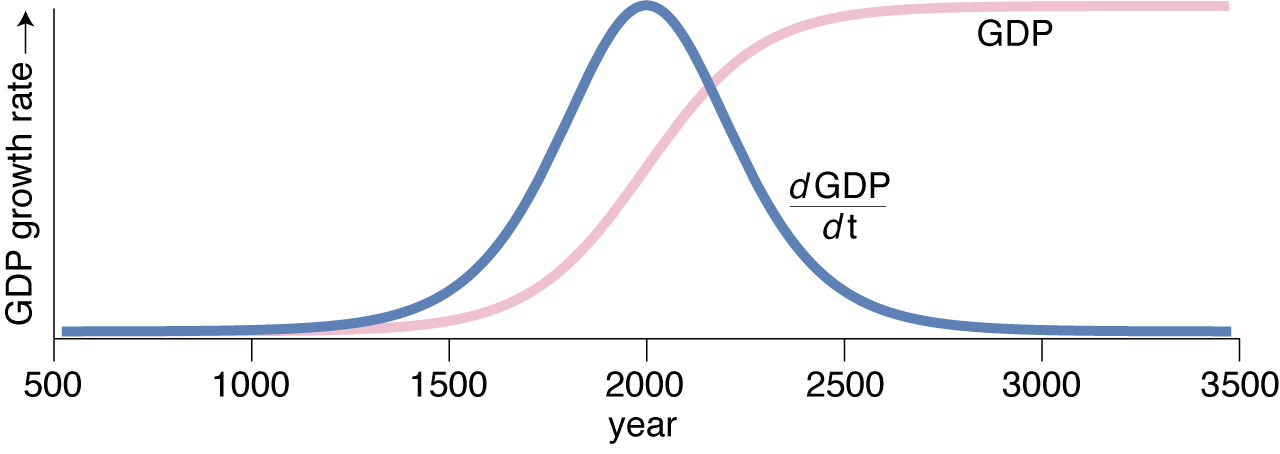

Porter has an answer at the ready. The appropriate measure of economic vitality, he implies, is not GDP itself but the rate of growth in GDP, or in other words the first derivative of GDP as a function of time:

If the world follows the trajectory of the blue curve, we have already reached our peak of wellbeing. It’s all downhill from here.

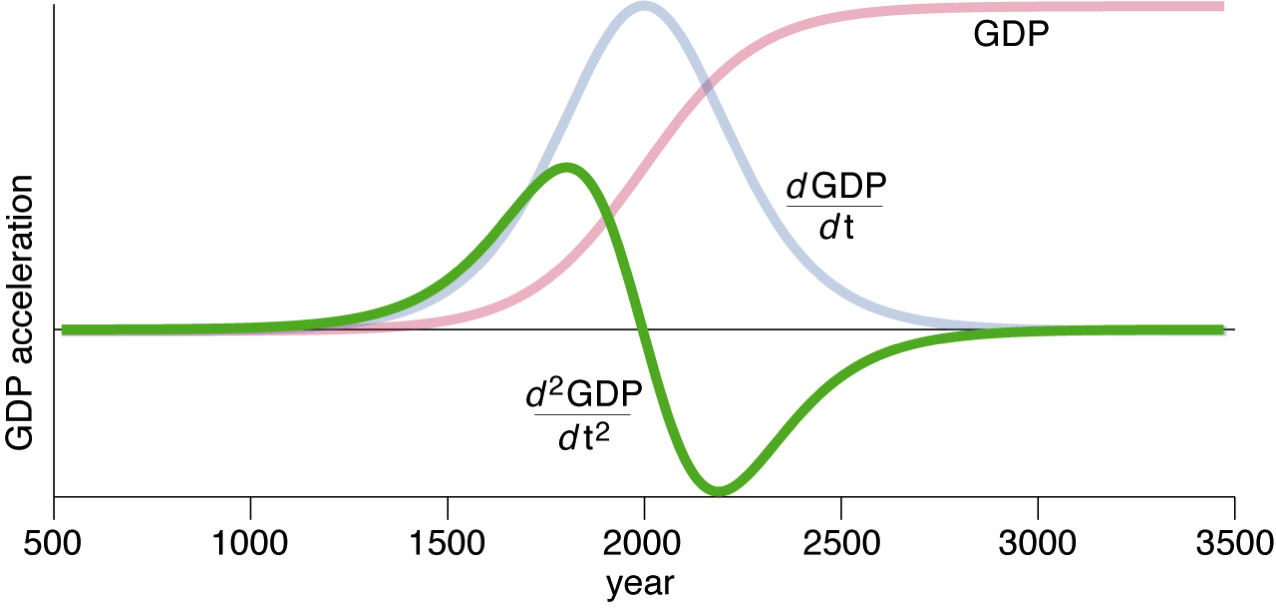

Some economists go even further, urging us to keep an eye on the second derivative of economic activity. Twenty-five years ago I was hired to edit the final report of an MIT commission on industrial productivity. Among the authors were two prominent economists, Robert Solow and Lester Thurow. I argued with them at some length about the following paragraph (they won):

In view of all the turmoil over the apparently declining stature of American industry, it may come as a surprise that the United States still leads the world in productivity. Averaged over the economy as a whole, for each unit of input the United States produces more output than any other nation. With this evidence of economic efficiency, is there any reason for concern? There are at least two reasons. First, American productivity is not growing as fast as it used to, and productivity in the United States is not growing as fast as it is elsewhere, most notably in Japan….

The phrase I have highlighted warns us that even though productivity is high and growing higher, we need to worry about the rate of change in the rate of growth:

Taking the second derivative (the green curve) as the metric of economic health, it appears we have already fallen back to the medieval baseline, and life is about to get even worse than it was at the time of the Mongol conquests; the Mad Max world will be an improvement over what lies in store in the near future.

Why should human happiness and the fate of civilization depend on the time derivative of GDP, rather than on GDP itself? Why do we need not just wealth, but more and more wealth, growing faster and faster? Again, Porter has an answer. Without growth, he says, economic life becomes a zero-sum game. “As Martin Wolf, the Financial Times commentator has noted, the option for everybody to become better off—where one person’s gain needn’t require another’s loss—was critical for the development and spread of the consensual politics that underpin democratic rule.” In other words, the function of economic growth is to blunt the force of envy in a world with highly skewed distributions of income and wealth. I’m not persuaded that growth per se is either necessary or sufficient to deal with this issue.

Porter’s essay on zero growth was prompted by the climate-change negotiations now under way in Paris. He worries (along with many others) that curtailing consumption of fossil fuels will lead to lower overall production and consumption of goods and services. That’s surely a genuine risk, but what’s the alternative? If burning more and more carbon is the only way we can keep our civilization afloat, then somebody had better send for Mad Max. The age of fossil fuels is going to end, sooner or later, if not because of the climatic effects then because the supply is finite.

Economic growth is not necessarily tied to the carbon budget, but it can’t be cut loose entirely from physical resources. Even the ethereal goods that are now so prominent in commerce—code and data—require some sort of material infrastructure. Ultimately, whether growth continues is not a question of social and economic policy or moral philosophy; it’s a matter of physics and mathematics. I’m with Kenneth Boulding. I don’t see Mad Max in our future, but I’m not counting on perpetual growth, either.

I’m currently reading Countdown by Alan Weisman which is about overpopulation. Tremendous book. In it Weisman deals with countries like Japan that are moving to negative growth, and how most countries see expanding populations as necessary for continued continued growth.

Basically, Capitalism is a Ponzi scheme depending on always having more people, resources and expanding consumption. I say we’ll end up with Mad Max when we run out of natural resources to support an ever growing population.

The real interesting mathematics is in designing an economy based on a steady-state model with the number of people that the Earth can safely support.

It’s curious. Rapid population growth and rapid economic growth began at roughly the same time. Demographers are sure that population growth will end, and total population will level off; in other words, the current high-growth regime is just a transitional period. But economic growth, we’re told, is (or must be) permanent.

Let’s gloss over the complete lack of any evidence supporting Porter’s argument. Let’s forget that quasi-zero growth gave us also ancient civilizations whereas fast growth gave us two world wars. Selective memory over millennia can do wonders. The interesting part in Porter’s delusional world is that growth is the necessary antidote to … equality. Since a fair society can not be achieved or even mentioned as an alternative, the laws of physics, and, why not, even mathematics, have to be bent to allow the haves to continue to dominate over the have-nots. Impressive, and impressive to read it in the NYT.

The problem is, birth rates have been plummeting for some time. Even in the US, we have technically been at a sub-replacement birth rate since 1971, the year I was a junior in high school (and I turn 62 this month)!

Worldwide, if there is anything that correlates (with a lag time, to be sure) with economies spiraling downward, is and has been, birth rate declines.

Harry S Dent Jr, a businessman with an MBA from Harvard, turned self-proclaimed economist, claims he can show a strong correlation, with about a 45- to 50 year lag between birth rates and the S&P 500 index.

Europe’s TFI (Total Fertility Index, or, the number of children each woman bears, on average, per lifetime) has been hovering around 138 or so for some time. Europe in total, has an overall population approaching 1/2 billion people. But, for some time, it has been losing net population at a rate of over 2 million more deaths net, ‘continent’ wide, than births per year for some time!

In “Demographic Winter” (a 2006 nearly hour long documentary, available in its entirety on YouTube), Nobel laureate economist Gary S Becker claims that Adam Smith, the author of the 1776 economic tome, ‘Wealth of Nations’ essentially pointed out that economic growth IS tied to population growth. He predicted that North America’s economies would eventually outstrip those of Europe (many decades before it happened), because, on average, their birth rate was nearly twice as high as that of Europle’s. He was essentially correct.

Many demographers argue that within the lifetime of many now living, they will start to see populations decline at an exponential rate, just as they have grown at such rates.

Nicholas Eberstadt, PhD from Harvard, again, in ‘Demotgraphic Winter’, says that the reason population has grown so fast over the last century or so in the world, is not due to people “suddenly breeding like rabbits”, but rather because they “quit dying like flies!” What has caused to population boom, he argues, has been caused by a healthcare or health explosion, That is, we have kept many more people alive from infancy to old age, than we use to.

So, population ‘growth’ has been much more at the ‘back end’, rather than at the ‘front end’ of things.

But, not only WILL this change. It HAS changed, and CONTINUES to change.

Personally, I believe we are currently in, and will STAY in overall permanent economic depression UNLESS and UNTIL we go back to having traditional families, where primarily the father works outside of the home, and the mother stays at home, having and raising a ‘sufficient’ number of children (I would estimate this number to be 5 or more, on average).

The other contributing factor to economic decline, has been a Ponzi scheme sponsored by governments, called ‘socialism’. This scheme, IMO, causes a delusion that ‘government’ will take care of us (via ‘pensions’, like Social Security, and MediCare, in our old age. And hence, since that is thought to be ‘true’, we have to a great degree quit getting married, and quit bearing and raising at least a ‘sufficient’ number of children—going into ever greater amounts of national economic debt to fund this pyramid or Ponzi scheme.

Ponzi schemes were long ago made illegal for ‘private’ practitioners. But, because government decides what is legal, and what is illegal, it has reserved this pyramid, or Ponzi scheme, called socialism, for itself. Just like Bernie Madoff’s Ponzi scheme eventually collapsed, because it was unsustainable, so I predict that socialism, or state-sponsored pyramid or Ponzi scheme, will likewise collapse.

Remember, Mr Madoff kept his scheme running for close to half a century! (And HIS program was completely contributed to on a ‘voluntary’ basis)!

Even coerced pyramid schemes, sponsored by government, cannot keep such schemes running indefinitely. They ALL will, sooner or later, collapse, under their own unsustainable economic weight. Greece is a ‘poster child’, IMO, of this fact!

diligentdave, do I understand correctly that you advocate families raising 5 or more children on average?

It seems to me that this would imply unlimited population growth, which is impossible on a finite planet with finite resources, unless you also advocate for people “dying like flies” again (i.e. that about half the children will die before forming families themselves) or expect space colonisation soon.

I do not understand either option: Why would anyone want people to die young? Why would anyone want population to grow until there’s not enough food for everyone? As to space colonisation, I wouldn’t rely on it before it’s possible.

This can only be sarcasm.

Regarding climate change fossil fuels:

We should see the Earth as what it is: A finite storage of resources we have to exploit to its fullest so we can leave the planet and start exploiting the abundant resources of our solar system. Only that way infinite growth is possible. (And I think everyone can agree that infinite growth is necessary to keep humanity afloat).

If we start “protecting nature” too much and dial back our energy consumption our species will never leave this rock and will vanish into nothingness.

The observable universe is just as finite as the Earth. If I remember correctly, at a mid-20C rate of exponential population growth, it fills up around the year 4500 with human bodies, leaving no room for stars, planets, or anything else. No, infinite population growth is impossible.

The idea of infinite economic growth is more subtle. The idea is that there is no such thing as “extracting the last drop of oil” (or whatever). As we go on, the price of oil rises such that new methods of obtaining it (or even creating it) become economically feasible that weren’t before. We have seen this happen with iron: first we mined all the hematite, then the taconite, and now far and away the best iron ore available is scrap steel.

Author confuses units from step 1 to step 2 of his arguments.

Step 1 starts with an “S” shaped graph of GDP/Capita. Step 2 shows derivative of the curve, but is labeled as dGDP/dt, ignoring dCapita/dt. Author does not consider historical changes in demographics when GDP growth slows.

See demographic Japan, Europe, US for examples of how population growth rates change due to economic and war-related shocks. Also see motivation for China ending the 1 child policy - they want to bring the cost of labor back down and they need a higher pop growth rate to generate enough economic activity to pay pensions, retirement, healthcare for expensive retirement-age cohort where people are living longer and thus costing the country much more.

Author should have challenged Porter’s initial claim: “Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.”

While it makes for a good soundbyte, it ignores the symbiotic and (usually) directly proportional but lagged/leading relationship of economic growth and population growth.

One child per family would lead to a decline of the population in the long run. So this policy would need to be abolished if the goal was to stabalize the population at some point. Abolishing it does not imply that China seeks population growth.

In my opinion the “Mad Max” scenario relies on our conceivable inability to get rid of capitalism (and economists) in the nearer future. This could be the case, since mankind is usually only slowly learning, especially concerning effects in the long run. On the other hand, there was a “French Revolution” once and surely there will be another one, before we enter the “Mad Max” stage. If humans would realize that a world, where everyone can live according to his needs and not his greed, is possible, economic growth would be a superfluous concept, something no longer needed, like inquisition or the like of the middle ages. For this one has to realize that money is power and power has to be controlled, like it already is the case in politics (checks and balances) and even in economics, concerning trusts and monopolists. Only in the private sector no one forbids to amass as many money as one likes to. THIS has to end some day.

The economics of infinite growth, AKA the economics of the cancer cell.

Bound to end (and even progress) well.