April Fool Redux

by Brian Hayes

Published 28 March 2020

I have a scheme to rescue the swooning U.S. economy. My idea partakes of the silliness that always accompanies the coming of April, but it’s not entirely an April Fool joke. T. S. Eliot told us that April is the cruelest month. I’m proposing that if we take a double dose of April, it might turn kinder. Let me explain.

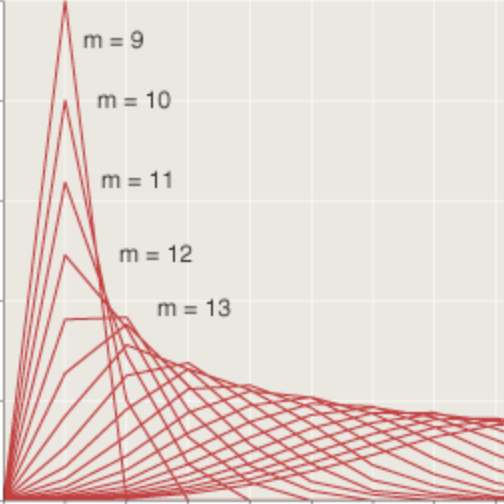

The economy’s swan dive is truly breathtaking. In response to the coronavirus threat we have shut down entire commercial sectors: most retail stores, restaurants, sports and entertainment. Travel and tourism are moribund. Manufacturing is threatened too, not only by concerns about workplace contagion but also by softening demand and disrupted supply chains. All of the automakers have closed their assembly plants in the U.S., and Boeing has stopped production at its plants near Seattle, which employ 70,000. Thus it comes as no great surprise—though it’s still a shock—that 3,283,000 Americans filed claims for unemployment compensation last week. That’s by far the highest weekly tally since the program was created in the 1930s. It’s almost five times the previous record from 1982, and 15 times the average for the first 10 weeks of this year. The graph is a dramatic hockey stick:

New weekly claims for unemployment compensation set an all-time record in the week ending 21 March: 3,283,000 claims. The previous record was less than 700,000, and in recent years claims have generally hovered a little above 200,000 per week. When a graph looks like this one, it’s usually because somebody misplaced a decimal point in preparing the data. This one’s for real. Data from U.S. Department of Labor.

Here’s the same graph, updated to include new unemployment claims for the weeks ending 28 March and 4 April. The four-week total of new claims is over 16 million, which is roughly 10 percent of the American workforce. [Edited 2020-04-02 and 2020-04-09.]

Claims for unemployment compensation totaled almost 13.5 million for the weeks ending 28 March and 4 April. Data from U.S. Department of Labor.

I’ve been brooding about the economic collapse for a couple of weeks. I worry that the consequences of unemployment and business failures could be even more dire than the direct harm caused by the virus. Recovering from a deep recession can take years, and those who suffer most are the poor and the young. I don’t want to see millions of lives blighted and the dreams of a generation thwarted. But Covid-19 is still rampant. Relaxing our defenses could swamp the hospitals and elevate the death rate. No one is eager to take that risk (except perhaps Donald Trump, who dreams of an Easter resurrection).

The other day I was squabbling about these economic perils with the person I shelter-in-place with. Yes, she said, we’re facing a steep decline, but what makes you so sure it’s going to last for years? Why can’t the economy bounce back? I patiently mansplained about the irreversibility of events like bankruptcy and eviction and foreclosure, which are almost as hard to undo as death. That argument didn’t settle the matter, but we let the subject drop. (We’re hunkered down 24/7 here; we need to get along.)

In the middle of the night, the question came back to me. Why won’t it bounce back? Why can’t we just pause the economy like a video, then a month or two later press the play button to resume where we left off?

One problem with pausing the economy is that people can’t survive in suspended animation. They need a continuous supply of air, water, food, shelter, TV shows, and toilet paper. You’ve got to keep that stuff coming, no matter what. But people are only part of the economy. There are also companies, corporations, unions, partnerships, non-profit associations—all the entities we create to organize the great game of getting and spending. A company, considered as an abstraction, has no need for uninterrupted life support. It doesn’t eat or breathe or get bored. So maybe companies could be put in the deep freeze and then thawed when conditions improve.

Lying awake in the dark, I told myself a story:

Clare owns a little café at the corner of Main and Maple in a New England college town. In the middle of March, when the college sent the students home, she lost half her customers. Then, as the epidemic spread, the governor ordered all restaurants to close. Clare called up Rory the Roaster to cancel her order for coffee beans, pulled her ad from the local newspaper, and taped a “C U Soon” sign to the door. Then she sat down with her only employee, Barry the Barista, to talk about the bad news.

Barry was distraught. “I have rent coming due, and my student loan, and a car payment.”

“I wish I could be more help,” Clare replied. “But the rent on the café is also due. If I don’t pay it, we could lose the lease, and you won’t have a job to come back to. We’ll both be on the street.” They sat glumly in the empty shop, six feet apart. Seeing the lost-puppy look in Barry’s eyes, Clare added: “Let me call up Larry the Landlord and see if we can work something out.”

Larry was sympathetic. He’d been hearing from lots of tenants, and he genuinely wanted to help. But he told Clare what he’d told the rest: “The building has a mortgage. If I don’t pay the bank, I’ll lose the place, and we’ll all be on the street.”

You can guess what Betty the Banker said. “I have obligations to my depositors. Accounts earn interest every month. People are redeeming CDs. If I don’t maintain my cash reserves, the FDIC will come in and seize our assets. We’ll all be on the street.”

Everyone in this little fable wants to do the right thing. No one wants to put Clare out of business or leave Barry without an income. And yet my nocturnal meditations come to a dark end, in which the failure of Clare’s corner coffee shop triggers a worldwide recession. Barry gets evicted, Larry defaults on his loan, Betty’s bank goes bottom up. Rory the Roaster also goes under, and the Colombian farm that supplies the beans lays off all its workers. With Clare’s place now an empty storefront, there are fewer shoppers on Main Street, and the bookstore a few doors away folds up. The newspaper where Clare used to advertise ceases publication. The town’s population dwindles. The college closes.

At this point I feel like Ebenezer Scrooge pleading with the Ghost of Christmas Future to save Tiny Tim, or George Bailey desperate to escape the mean streets of Potterville and get back to the human warmth of Bedford Falls. Surely there must be some way to avert this catastrophe.

Here’s my idea. The rent and loan payments that cause all this economic mayhem are different from the transactions that Clare handles at her cash register. In her shopkeeper economy, money comes in only when coffee goes out; the two events are causally connected and simultaneous. And if she’s not selling any coffee, she can stop buying beans. The payment of her rent, on the other hand, is triggered by nothing but the ticking of the clock. She is literally buying time. Now the remedy is obvious: Stop the clock, or reset it. This is easier than you might think. We just go skipping down the Yellow Brick Road and petition the wizard to issue a proclamation. The wizard’s decree says this:

Redux is Latin for “a thing brought back or restored.” The word was introduced—or brought back—into the modern American vocabulary by John Updike’s 1971 novel Rabbit Redux, having been used earlier in titles of works by Dryden and Trollope. It’s one of those words I’ve always avoided saying aloud because of doubt about the pronunciation. The OED says it’s re-ducks.In other words, we’re going to do April, and then we’re going to do it again. April is followed by April Redux, and only after we get to the end of that month do we start on May.

How does this fiddling with the calendar help Clare? Consider what happens when the calendar flips from April 30 to April 1 Redux. It’s the first of the month, and the rent is due. But wait! No it’s not. She already paid the rent for April, a month ago. It won’t be due again until May 1, and that’s a month away. It’s the same with Larry’s mortgage payment, and Barry’s car loan. Of course stopping the clock cuts both ways. If you get a monthly pension or Social Security payment, that won’t be coming in April Redux, nor will the bank pay you interest on your deposits.

By means of this sly maneuver we have broken a vicious cycle. Larry doesn’t get a rent check from Clare, but he also doesn’t have to write a mortgage-loan check to Betty, who doesn’t have to make payments to her depositors and creditors. Each of them gets a month’s reprieve. With this extra slack, maybe Clare can keep Barry on the payroll and still have a viable business when her customers finally come out of hiding.

But isn’t this just a sneaky scheme to deprive the creditor class of money they are legally entitled to receive under the terms of contracts that both parties willingly signed? Yes it is, and a clever one at that. It is also a way to more equitably distribute the risks and costs of the present crisis. At the moment the burden falls heavily on Clare and Barry, who are forbidden to sell me a cup of coffee; but Larry and Betty are free to go on collecting their rents and loan payments. In addition to spreading around the financial pain, the scheme might also reduce the likelihood of a major, lasting economic contraction, which none of these characters would enjoy.

In spite of these appeals to the greater good of society as a whole, you may still feel there’s something dishonest about April Redux. If so, we can have the wizard issue a second decree:

every month shall have one day fewer than the usual number.

During this period every scheduled payment will come due a day sooner than usual. At the end, lenders and borrowers are even-steven.

The last time anybody tinkered with the calendar in the English-speaking world was 1752, when the British isles and their colonies finally adopted the Gregorian calendar (introduced elsewhere as early as 1592). My source for this revisionist history is: Poole, Robert. “Give Us Our Eleven Days!”: Calendar Reform in Eighteenth-Century England. Past & Present, no. 149, 1995, pp. 95–139. JSTOR (paywall).By act of parliament, Wednesday September 2 was followed by Thursday September 14. Many accounts of this event tell of rioting in the streets, as ignorant mobs complained that parliament had stolen 11 days of their lifespan. Later scholarship shows that the riots were an invention of imaginative or gullible historians, but there was concern and controversy about the proper calculation of wages, rents, and interest in the abbreviated September.

Riots in the streets are clearly a no-no in this period of social distancing, so presumably we won’t have to worry about mob action when April repeats itself. Besides, who’s going to complain about having 30 days added to their lifespan? I suppose there may be some grumbling from people with April birthdays, who think they are suddenly two years older. And back-to-back April Fool days could test the nation’s patience.

Although my plan for an April do-over is presented in the spirit of the season, I do think it illuminates a serious issue—an aspect of modern commerce that makes the current situation especially dangerous. Our problem is not that we have shut down the whole economy. The problem is that we’ve shut down only half the economy. The other half carries on with business as usual, creating imbalances that leave the whole edifice teetering on the brink of collapse.

The $2 trillion rescue package enacted last week addresses some of these issues. The cash handout for individual taxpayers, and a sweetening of unemployment benefits, should help Barry muddle through and pay his bills. A program of loans for small businesses could keep Clare afloat, and the loan would be forgiven if she keeps Barry on the payroll. These are thoughtful and useful measures, and a refreshing change from earlier bailout practices. We are not sending all the funds directly to investment banks and insurance companies. But a big share will wind up there anyway, since we are effectively subsidizing the rent and mortgage payments of individuals and small businesses. I wonder if it wouldn’t be fairer, more effective, and less expensive to curtail some of those payments. I’m not suggesting that we shut down the banks along with the shops; that would make matters worse. But we might require financial institutions to defer or forgo certain payments from distressed small businesses and the employs they lay off.

Voluntary efforts along these lines promise to soften the impact for at least a few lucky workers and businesses that have lost their revenue stream. In my New England college town, some of the banks are offering to defer monthly payments on mortgage loans, and there’s social pressure on landlords to do defer rents.

But don’t count on everyone to follow that program. On March 31, following announcements of layoffs and furloughs by Macy’s, Kohl’s, and other large retailers, the New York Times reported: “Last week, Taubman, a large owner of shopping malls, sent a letter to its tenants saying that the company expected them to keep paying their rent amid the crisis. Taubman, which oversees well-known properties like the Mall at Short Hills in New Jersey, reminded its tenants that it also had obligations to meet, and was counting on the rent to pay lenders and utilities.” [Added 2020-03-31.]

The coronavirus crisis is being treated as a unique event (and I certainly hope we’ll never see the like of it again). The associated economic crisis is also unique, at least within my memory. Most panics and recessions have their roots in the financial markets. At some point investors realize that tech stocks with an infinite price-to-earnings ratio are not such a bargain after all, or that bundling together thousands of risky mortgages doesn’t actually make them less risky. When the bubble bursts, the first casualties are on Wall Street; only later do the ripple effects reach Clare’s café. Now, we are seeing a rare disturbance that travels in the opposite direction. Do we know how to fix it?

Responses from readers:

Please note: The bit-player website is no longer equipped to accept and publish comments from readers, but the author is still eager to hear from you. Send comments, criticism, compliments, or corrections to brian@bit-player.org.

Publication history

First publication: 28 March 2020

Converted to Eleventy framework: 22 April 2025

You make a very important point that the passage of time triggers financial consequences. Of course one reason we have set up our economy that way is that the passage of time triggers physical consequences as well. As time passes, we get hungry. So we can’t really put the economy in suspended animation. In fact, were we to do that, we may find the COVID-19 plague also in suspended animation, ready to continue when we turned the world back on.

So what can we do? We can identify many of the phenomena that occur more or less on their own with the passage of time. I say more or less because there are always things like accidents that have a probability of occurring but aren’t triggered specifically by the passage of time.

But suppose we could partition the world into triggered-by-time and everything else. We would need some mechanism to deal with the human needs that are triggered by time. Many of them could be solved with government money, but obviously some, like food, can’t. We need real food and real medical services, and real fire-fighting services, etc.

So some people will have to work. The government would have to pay them. It would also have to give people enough money to buy the food. And a banking system would be required so that the money could be buffered and transferred.

This would be an interesting little experiment: what is the minimum society needs to sustain itself over a limited period of time?

You raise a deep question; this is without doubt one of those difficult to understand questions in plain sight.

It would be nice to stop the clock, or alter the calendar by fiat to ‘forgive and forget’ periodic socioeconomic crises, but how do you get debtors and creditors to mutually cancel their commitments? This might have been the solution in 2008 as well; mutual global erasure of IOUs on the instructions of the BIS / IMF with the cleansed system starting all over again. But who will make this happen? We no longer have Emperors or Popes with clout.

On a conceptual tack, time per se isn’t axiological but an abstract relation that merely helps to structure commercial commitments, that are axiological. An economy ‘emerges’ but not necessarily by day or hour etc. Actuaries construct ‘claims development curves’ where it often isn’t salient to analyse loss events in terms of current (year) claims but in a continuous, scaleless emergence.

Even if credit and investment crises are ‘phantom’ and can be obliterated by mutual consent, what happens to the consequences of car accidents, earthquakes and illness that occur in the ‘month of oblivion’. Life goes on without the calendar.

Economic and social phenomena have characteristic forms that need not be understood temporally and can’t be manipulated at the ‘temporal end,’ as they don’t have one.

Another path to tackling this is Roget’s categories - he places ‘time’ (abstract relation) at degree 106 but a promise (‘conditional inter-social volition’) at 768. The degrees are indicative of axiological intensity and integrated, not serial. Time and promises are radically different things with promises supervening on time.

I enjoy your books and own a 2005 copy of Infrastructure.